策略名称

C++期货高频套币策略OKEX Websocket版

策略作者

小小梦

策略描述

�策略原理

策略原理为非常简单的,OKEX合约跨期对冲,仓位控制设计方面,设计为差价网格对冲。 策略定义两个合约,A合约,B合约。可以合约设置不同的合约代码,进行对冲。 例如,设置 A 合约为季度合约,B合约为当周合约(也可以设置 A 为近期合约,B为远期合约,其它定义就是相反的)。 对冲操作即分为 做空A合约(季度),做多B合约(类似 商品期货中跨期套利的做空远期合约,做多近期合约,进行正套) 做多A合约,做空B合约(类似商品期货中的做空近期,做多远期,进行反套)

-

-

代码语言 策略编写代码使用C++语言,具有速度快的性能优势。

-

行情驱动: 行情驱动采用OKEX websocket 接口接受交易所推送行情,最新行情获取较为及时,行情数据使用数据量不大的实时tick数据, 对于行情响应速度有不小提升。对于tick 数据,策略专门构造了一个K线生成器,用来对获取到的tick数据计算后的合约差价,进行K线合成。 策略对冲操作的开仓、平仓 均由该K线生成器类对象生成的数据驱动。

-

仓位控制 仓位控制采用类似 「波菲纳契」数列的对冲仓位比例,进行控制。 实现差价越大,套利对冲数量相对增加,对仓位进行分散,从而把握住小差价波动小仓位,大差价波动仓位适当增大。

-

平仓:止损止盈 固定的止盈差价,止损差价。 持仓差价到达止盈位置、止损位置即进行止盈、止损。

-

入市、离市 周期设计 �参数 NPeriod 控制的周期对策略的开仓平仓进行一定的动态控制。

-

仓位平衡系统、订单检测系统 策略有专门的定期检测 平衡系统。 订单检测系统。

-

策略扩展 策略代码设计耦合度较低,可扩展为商品期货对冲,或者进行进一步优化,修改。

-

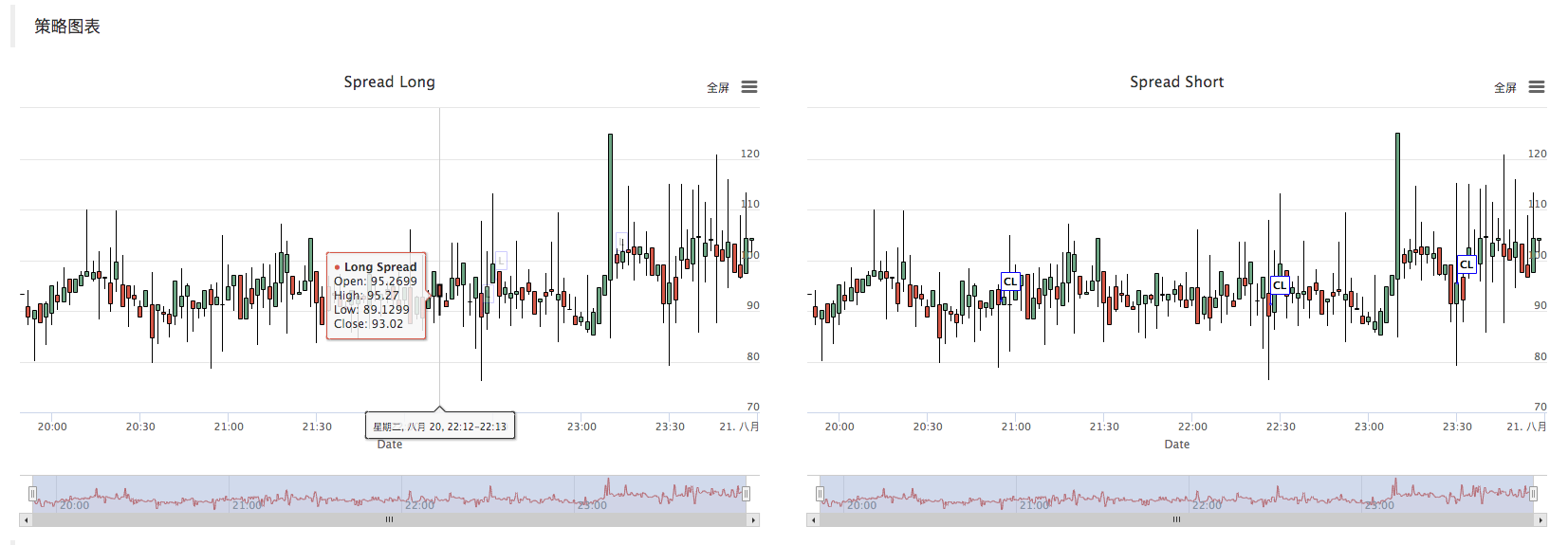

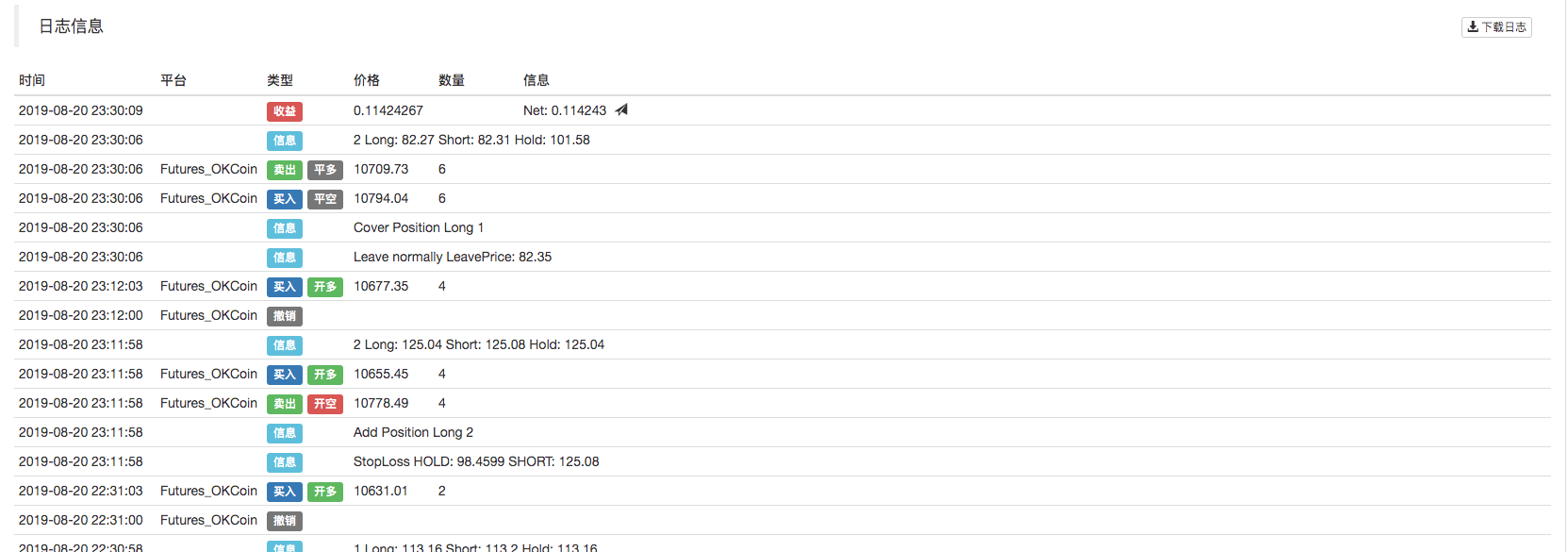

策略图表 策略自动生成差价 K线图表,标记相关交易信息。

-

策略参数

| 参数 | 默认值 | 描述 |

|---|---|---|

| InstrumentA | this_week | 近期合约 |

| InstrumentB | next_week | 远期合约 |

| DPeriod | 30 | 差价周期(秒) |

| NPeriod | 20 | 周期 |

| LeavePeriod | 5 | 出场周期 |

| AddMax | 5 | 加仓次数 |

| StopLoss | 10 | 止损差价 |

| StopWin | 30 | 止盈差价 |

| OpenAmount | 10 | 手数 |

| SlidePrice | true | 滑价 |

| MaxDelay | 500 | 最大行情延迟(毫秒) |

| IsSetProxy | false | (?代理)是否代理设置 |

| Proxy | 代理设置 |

源码 (cpp)

/*backtest

start: 2019-07-22 00:00:00

end: 2019-08-21 00:00:00

period: 1m

exchanges: [{"eid":"Futures_OKCoin","currency":"BTC_USD","stocks":0.1,"fee":[0.02,0.05]}]

args: [["InstrumentB","quarter"],["NPeriod",200],["LeavePeriod",100],["AddMax",3],["StopLoss",20],["StopWin",50],["OpenAmount",2]]

*/

enum State {

STATE_NA,

STATE_IDLE,

STATE_HOLD_LONG,

STATE_HOLD_SHORT,

};

string replace(string s, const string from, const string& to) {

if(!from.empty())

for(size_t pos = 0; (pos = s.find(from, pos)) != std::string::npos; pos += to.size())

s.replace(pos, from.size(), to);

return s;

}

class BarFeeder {

public:

BarFeeder(int period) : _period(period) {

_rs.Valid = true;

}

void feed(double price, Chart *c=nullptr, int chartIdx=0) {

uint64_t epoch = uint64_t(Unix() / _period) * _period * 1000;

bool newBar = false;

if (_rs.size() == 0 || _rs[_rs.size()-1].Time < epoch) {

Record r;

r.Time = epoch;

r.Open = r.High = r.Low = r.Close = price;

_rs.push_back(r);

if (_rs.size() > 2000) {

_rs.erase(_rs.begin());

}

newBar = true;

} else {

Record &r = _rs[_rs.size() - 1];

r.High = max(r.High, price);

r.Low = min(r.Low, price);

r.Close = price;

}

auto bar = _rs[_rs.size()-1];

json point = {bar.Time, bar.Open, bar.High, bar.Low, bar.Close};

if (c != nullptr) {

if (newBar) {

c->add(chartIdx, point);

c->reset(1000);

} else {

c->add(chartIdx, point, -1);

}

}

}

Records & get() {

return _rs;

}

private:

int _period;

Records _rs;

};

class Hedge {

public:

Hedge() {

_isCover = true;

_needCheckOrder = true;

_st = STATE_NA;

for (int i = 0; i < AddMax + 1; i++) {

if (_addArr.size() < 2) {

_addArr.push_back((i+1)*OpenAmount);

}

_addArr.push_back(_addArr[_addArr.size()-1] + _addArr[_addArr.size()-2]);

}

_cfgStr = R"EOF(

[{

"extension": { "layout": "single", "col": 6, "height": "500px"},

"rangeSelector": {"enabled": false},

"tooltip": {"xDateFormat": "%Y-%m-%d %H:%M:%S, %A"},

"plotOptions": {"candlestick": {"color": "#d75442", "upColor": "#6ba583"}},

"chart":{"type":"line"},

"title":{"text":"Spread Long"},

"xAxis":{"title":{"text":"Date"}},

"series":[

{"type":"candlestick", "name":"Long Spread","data":[], "id":"dataseriesA"},

{"type":"flags","data":[], "onSeries": "dataseriesA"}

]

},

{

"extension": { "layout": "single", "col": 6, "height": "500px"},

"rangeSelector": {"enabled": false},

"tooltip": {"xDateFormat": "%Y-%m-%d %H:%M:%S, %A"},

"plotOptions": {"candlestick": {"color": "#d75442", "upColor": "#6ba583"}},

"chart":{"type":"line"},

"title":{"text":"Spread Short"},

"xAxis":{"title":{"text":"Date"}},

"series":[

{"type":"candlestick", "name":"Long Spread","data":[], "id":"dataseriesA"},

{"type":"flags","data":[], "onSeries": "dataseriesA"}

]

}

]

)EOF";

_c.update(_cfgStr);

_c.reset();

};

State getState(string &symbolA, Depth &depthA, string &symbolB, Depth &depthB) {

if (!_needCheckOrder && _st != STATE_NA) {

return _st;

}

//Log("sync orders");

auto orders = exchange.GetOrders();

if (!orders.Valid) {

return STATE_NA;

}

if (orders.size() > 0) {

for (auto &order : orders) {

exchange.CancelOrder(order.Id);

}

return STATE_NA;

}

Sleep(500);

//Log("sync positions");

auto positions = exchange.GetPosition();

if (!positions.Valid) {

return STATE_NA;

}

// cache orders and positions;

_needCheckOrder = false;

if (positions.size() == 0) {

//Log("Position is empty");

return STATE_IDLE;

}

State st[2] = {STATE_IDLE, STATE_IDLE};

double holdAmount[2] = {0, 0};

double holdPrice[2] = {};

for (auto &pos : positions) {

int idx = -1;

if (pos.ContractType == symbolA) {

idx = 0;

} else if (pos.ContractType == symbolB) {

idx = 1;

}

if (idx >= 0) {

holdPrice[idx] = pos.Price;

holdAmount[idx] += pos.Amount;

st[idx] = pos.Type == PD_LONG || pos.Type == PD_LONG_YD ? STATE_HOLD_LONG : STATE_HOLD_SHORT;

}

}

if (holdAmount[0] > holdAmount[1]) {

st[1] = STATE_IDLE;

} else if (holdAmount[0] < holdAmount[1]) {

st[0] = STATE_IDLE;

}

if (st[0] != STATE_IDLE && st[1] != STATE_IDLE) {

// update

_holdPrice = _N(holdPrice[1] - holdPrice[0], 4);

_holdAmount = holdAmount[0];

return st[0];

} else if (st[0] == STATE_IDLE && st[1] == STATE_IDLE) {

return STATE_IDLE;

} else {

double amount = abs(holdAmount[0] - holdAmount[1]);

auto idx_fat = st[0] == STATE_IDLE ? 1 : 0;

if (_isCover) {

exchange.SetContractType(st[0] == STATE_IDLE ? symbolB : symbolA);

if (st[idx_fat] == STATE_HOLD_LONG) {

exchange.SetDirection("closebuy");

exchange.Sell((st[0] == STATE_IDLE ? depthB.Bids[0].Price: depthA.Bids[0].Price)-SlidePrice, amount);

} else {

exchange.SetDirection("closesell");

exchange.Buy((st[0] == STATE_IDLE ? depthB.Asks[0].Price : depthA.Asks[0].Price)+SlidePrice, amount);

}

} else {

exchange.SetContractType(st[0] == STATE_IDLE ? symbolA : symbolB);

if (st[idx_fat] == STATE_HOLD_LONG) {

exchange.SetDirection("sell");

exchange.Sell((st[0] == STATE_IDLE ? depthA.Bids[0].Price : depthB.Bids[0].Price)-SlidePrice, amount);

} else {

exchange.SetDirection("buy");

exchange.Buy((st[0] == STATE_IDLE ? depthA.Asks[0].Price : depthB.Asks[0].Price)+SlidePrice, amount);

}

}

_needCheckOrder = true;

return STATE_NA;

}

Log(positions);

Panic("WTF");

}

bool Loop(string &symbolA, Depth &depthA, string &symbolB, Depth &depthB, string extra="") {

_loopCount++;

auto diffLong = _N(depthB.Bids[0].Price - depthA.Asks[0].Price, 4);

auto diffShort = _N(depthB.Asks[0].Price - depthA.Bids[0].Price, 4);

_feederA.feed(diffLong, &_c, 0);

_feederB.feed(diffShort, &_c, 2);

auto barsA = _feederA.get();

auto barsB = _feederB.get();

if (barsA.size() < max(LeavePeriod, NPeriod) + 2) {

LogStatus(_D(), "Calc His", barsA.size());

return true;

}

bool expired = false;

auto seconds = Unix();

if (seconds - _lastCache > 600) {

_needCheckOrder = true;

expired = true;

}

State st = getState(symbolA, depthA, symbolB, depthB);

if (st == STATE_NA) {

return true;

}

if (st == STATE_IDLE) {

_holdPrice = 0;

}

// cache st

_st = st;

if (expired) {

_lastCache = seconds;

}

if (Unix() - seconds > 5) {

Log("skip this tick");

return true;

}

LogStatus(_D(), "State: ", _state_desc[st], "Hold:", _holdPrice, "Long:", diffLong, "Short:", diffShort, "Loop:", _loopCount, extra);

if (st == STATE_IDLE && _isCover) {

auto account = exchange.GetAccount();

if (account.Valid) {

double profit = _N(exchange.GetName() == "Futures_OKCoin" ? account.Stocks + account.FrozenStocks : account.Balance + account.FrozenBalance, 8);

LogProfit(profit, _hedgeCount > 0 ? format("Net: %f @", profit) : "");

}

_isCover = false;

return true;

}

auto ratio = abs(diffLong - diffShort);

bool condOpenLong = (st == STATE_IDLE || st == STATE_HOLD_LONG) && (diffLong - _countOpen * max(1.0, _holdPrice * 0.1)) > TA.Highest(barsA.High(), NPeriod) && _countOpen < AddMax;

bool condOpenShort = (st == STATE_IDLE || st == STATE_HOLD_SHORT) && (diffShort + _countOpen * max(1.0, _holdPrice * 0.1)) < TA.Lowest(barsB.Low(), NPeriod) && _countOpen < AddMax;

bool condCoverLong = false;

bool condCoverShort = false;

bool isLeave = false;

bool isStopLoss = false;

bool isStopWin = false;

if (st == STATE_HOLD_LONG) {

auto leavePrice = (diffShort + _countCover + ratio);

isLeave = leavePrice < TA.Lowest(barsB.Low(), LeavePeriod);

if (!isLeave) {

isStopLoss = diffShort - _holdPrice >= StopLoss;

if (!isStopLoss) {

isStopWin = _holdPrice - diffShort >= StopWin;

if (isStopWin) {

Log("Stop Win", "HOLD:", _holdPrice, "SHORT:", diffShort);

}

} else {

Log("StopLoss", "HOLD:", _holdPrice, "SHORT:", diffShort);

}

} else {

Log("Leave normally", "LeavePrice:", leavePrice);

}

condCoverLong = isLeave || isStopLoss || isStopWin;

} else if (st == STATE_HOLD_SHORT) {

auto leavePrice = (diffLong - _countCover - ratio);

isLeave = leavePrice > TA.Highest(barsA.High(), NPeriod);

if (!isLeave) {

isStopLoss = _holdPrice - diffLong >= StopLoss;

if (!isStopLoss) {

isStopWin = diffLong - _holdPrice >= StopWin;

if (isStopWin) {

Log("Stop Win", "HOLD:", _holdPrice, "LONG:", diffLong);

}

} else {

Log("StopLoss", "HOLD:", _holdPrice, "LONG:", diffLong);

}

} else {

Log("Leave normally", "LeavePrice:", leavePrice);

}

condCoverShort = isLeave || isStopLoss || isStopWin;

}

string action, color;

double opPrice;

int chartIdx = 0;

if (condOpenLong) {

// Must Increase

if (_countOpen > 0 && diffLong <= _holdPrice) {

return STATE_IDLE;

}

_isCover = false;

_countOpen++;

_countCover = 0;

_holdPrice = diffLong;

auto amount = _addArr[_countOpen];

if (_countOpen > 0) {

Log("Add Position Long", _countOpen);

}

exchange.SetContractType(symbolB);

exchange.SetDirection("sell");

exchange.Sell(depthB.Bids[0].Price-SlidePrice, amount);

exchange.SetContractType(symbolA);

exchange.SetDirection("buy");

exchange.Buy(depthA.Asks[0].Price+SlidePrice, amount);

action = "L";

color = "blue";

opPrice = diffLong;

chartIdx = 1;

} else if (condOpenShort) {

// Must Decrease

if (_countOpen > 0 && diffShort >= _holdPrice) {

return STATE_IDLE;

}

_isCover = false;

_countOpen++;

_countCover = 0;

_holdPrice = diffShort;

auto amount = _addArr[_countOpen];

if (_countOpen > 0) {

Log("Add Position Short", _countOpen);

}

exchange.SetContractType(symbolA);

exchange.SetDirection("sell");

exchange.Sell(depthA.Bids[0].Price-SlidePrice, amount);

exchange.SetContractType(symbolB);

exchange.SetDirection("buy");

exchange.Buy(depthB.Asks[0].Price+SlidePrice, amount);

action = "S";

color = "red";

opPrice = diffShort;

chartIdx = 3;

} else if (condCoverLong) {

_isCover = true;

_countOpen = 0;

_countCover++;

_hedgeCount++;

if (_countCover > 0) {

Log("Cover Position Long", _countCover);

}

exchange.SetContractType(symbolB);

exchange.SetDirection("closesell");

exchange.Buy(depthB.Asks[0].Price+SlidePrice, _holdAmount);

exchange.SetContractType(symbolA);

exchange.SetDirection("closebuy");

exchange.Sell(depthA.Bids[0].Price-SlidePrice, _holdAmount);

action = "CL";

color = "blue";

opPrice = diffShort;

chartIdx = 3;

} else if (condCoverShort) {

_hedgeCount++;

_isCover = true;

_countOpen = 0;

_countCover++;

if (_countCover > 0) {

Log("Cover Position Short", _countCover);

}

exchange.SetContractType(symbolA);

exchange.SetDirection("closesell");

exchange.Buy(depthA.Asks[0].Price+SlidePrice, _holdAmount);

exchange.SetContractType(symbolB);

exchange.SetDirection("closebuy");

exchange.Sell(depthB.Bids[0].Price-SlidePrice, _holdAmount);

action = "CS";

color = "blue";

opPrice = diffLong;

chartIdx = 1;

} else {

return true;

}

_needCheckOrder = true;

_c.add(chartIdx, {{"x", UnixNano()/1000000}, {"title", action}, {"text", format("diff: %f", opPrice)}, {"color", color}});

Log(st, "Long:", diffLong, "Short:", diffShort, "Hold:", _holdPrice);

return true;

}

private:

vector<double> _addArr;

string _state_desc[4] = {"NA", "IDLE", "LONG", "SHORT"};

int _countOpen = 0;

int _countCover = 0;

int _lastCache = 0;

int _hedgeCount = 0;

int _loopCount = 0;

double _holdPrice = 0;

BarFeeder _feederA = BarFeeder(DPeriod);

BarFeeder _feederB = BarFeeder(DPeriod);

State _st = STATE_NA;

string _cfgStr;

double _holdAmount = 0;

bool _isCover = false;

bool _needCheckOrder = true;

Chart _c = Chart("{}");

};

inline unsigned char toHex(unsigned char x) {

return x > 9 ? x + 55 : x + 48;

}

std::string urlencode(const std::string& str) {

std::string strTemp = "";

size_t length = str.length();

for (size_t i = 0; i < length; i++)

{

if (isalnum((unsigned char)str[i]) ||

(str[i] == '-') ||

(str[i] == '_') ||

(str[i] == '.') ||

(str[i] == '~'))

strTemp += str[i];

else if (str[i] == ' ')

strTemp += "+";

else

{

strTemp += '%';

strTemp += toHex((unsigned char)str[i] >> 4);

strTemp += toHex((unsigned char)str[i] % 16);

}

}

return strTemp;

}

uint64_t _Time(string &s) {

tm t_init;

t_init.tm_year = 70;

t_init.tm_mon = 0;

t_init.tm_mday = 1;

t_init.tm_hour = 0;

t_init.tm_min = 0;

t_init.tm_sec = 0;

tm t;

int year, month, day, hour, minute, second, ms;

sscanf(s.c_str(), "%d-%d-%dT%d:%d:%d.%dZ", &year, &month, &day, &hour, &minute, &second, &ms);

t.tm_year = year - 1900;

t.tm_mon = month - 1;

t.tm_mday = day;

t.tm_hour = hour;

t.tm_min = minute;

t.tm_sec = second;

t.tm_isdst = 0;

return uint64_t(mktime(&t))*1000+ms-uint64_t(mktime(&t_init))*1000;

}

void main() {

// exchange.IO("base", "https://www.okex.me"); // 测试

if (IsSetProxy) {

exchange.SetProxy(Proxy);

}

LogReset();

LogProfitReset();

SetErrorFilter("ready|timeout|500");

Log("Init OK");

string symbolA = InstrumentA;

string symbolB = InstrumentB;

Hedge h;

if (IsVirtual()) {

while (true) {

exchange.SetContractType(symbolA);

auto depthA = exchange.GetDepth();

if (depthA.Valid) {

exchange.SetContractType(symbolB);

auto depthB = exchange.GetDepth();

if (depthB.Valid) {

h.Loop(symbolA, depthA, symbolB, depthB);

}

}

}

return;

}

if (exchange.GetName() != "Futures_OKCoin") {

Panic("only support Futures_OKCoin");

}

string realSymbolA = exchange.SetContractType(symbolA)["instrument"];

string realSymbolB = exchange.SetContractType(symbolB)["instrument"];

string qs = urlencode(json({{"op", "subscribe"}, {"args", {"futures/depth5:" + realSymbolA, "futures/depth5:" + realSymbolB}}}).dump());

Log("try connect to websocket");

// wss://real.OKEx.com:8443/ws/v3

auto ws = Dial("wss://real.okex.com:8443/ws/v3|compress=gzip_raw&mode=recv&reconnect=true&payload="+qs);

// auto ws = Dial("wss://real.okex.me:8443/ws/v3|compress=gzip_raw&mode=recv&reconnect=true&payload="+qs);

Log("connect to websocket success");

Depth depthA, depthB;

auto fillDepth = [](json &data, Depth &d) {

d.Valid = true;

d.Asks.clear();

d.Asks.push_back({atof(string(data["asks"][0][0]).c_str()), atof(string(data["asks"][0][1]).c_str())});

d.Bids.clear();

d.Bids.push_back({atof(string(data["bids"][0][0]).c_str()), atof(string(data["bids"][0][1]).c_str())});

};

string timeA;

string timeB;

while (true) {

auto buf = ws.read();

// Log("buf:", buf); // 测试

json obj;

try {

obj = json::parse(buf);

} catch (json::parse_error& e) {

Log(buf);

Log(e.what());

continue;

}

if (obj["data"].size() == 0) {

continue;

}

auto data = obj["data"][0];

string ins = data["instrument_id"];

if (ins == realSymbolA) {

fillDepth(data, depthA);

timeA = data["timestamp"];

} else if (ins == realSymbolB) {

fillDepth(data, depthB);

timeB = data["timestamp"];

}

if (depthA.Valid && depthB.Valid) {

auto diffA = uint64_t(UnixNano()/1000000)-_Time(timeA);

auto diffB = uint64_t(UnixNano()/1000000)-_Time(timeB);

if (diffA > MaxDelay || diffB > MaxDelay) {

continue;

}

h.Loop(symbolA, depthA, symbolB, depthB, format("market delay (ms): %d, %d", diffA, diffB));

}

}

}

策略出处

https://www.fmz.com/strategy/163447

更新时间

2020-05-27 10:29:05