• We lend at the floor price of an NFT collection. By doing this, we can extend loans more widely and create a unified liquidity pool for lending. • There are 4 key events in our contract.

- Deposit - lend ether to the vault

- Withdraw - withdraw ether plus gains / losses

- Take Loan - deposit an NFT and get a loan in return

- Repay Loan - repay a loan, with interest.

• Currently a vault manager will need to call whitelistCollection to change a parameter like the lending price for an NFT collection. Is the current setup gas inefficient? • What vectors for abuse am I not thinking about? • Can large whale deposits be used to take gains and subsequantly remove liquidity and abuse the system? • Can re-entrancy attacks be used in takeLoan or withdrawFunds?

• Keep 10% of the vault liquid at all times for withdraws • Clarify when vaultBalance and vaultBalanceAvailable should be adjusted.

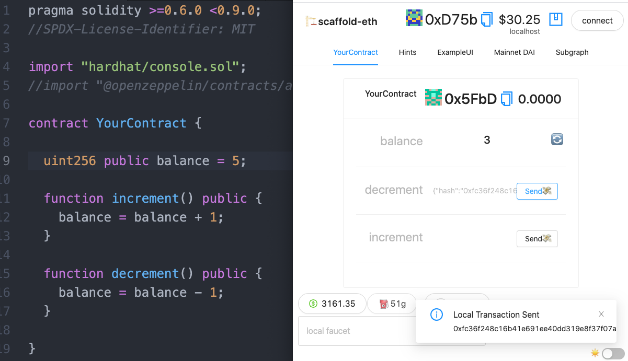

everything you need to build on Ethereum! 🚀

🧪 Quickly experiment with Solidity using a frontend that adapts to your smart contract:

Prerequisites: Node plus Yarn and Git

clone/fork 🏗 scaffold-eth:

git clone https://github.com/austintgriffith/scaffold-eth.gitinstall and start your 👷 Hardhat chain:

cd scaffold-eth

yarn install

yarn chainin a second terminal window, start your 📱 frontend:

cd scaffold-eth

yarn startin a third terminal window, 🛰 deploy your contract:

cd scaffold-eth

yarn deploy🔏 Edit the smart contract Tangelo.sol in packages/hardhat/contracts

📝 Edit your frontend App.jsx in packages/react-app/src

💼 Edit your deployment scripts in packages/hardhat/deploy

📱 Open http://localhost:3000 to see the app

Documentation, tutorials, challenges, and many more resources, visit: docs.scaffoldeth.io