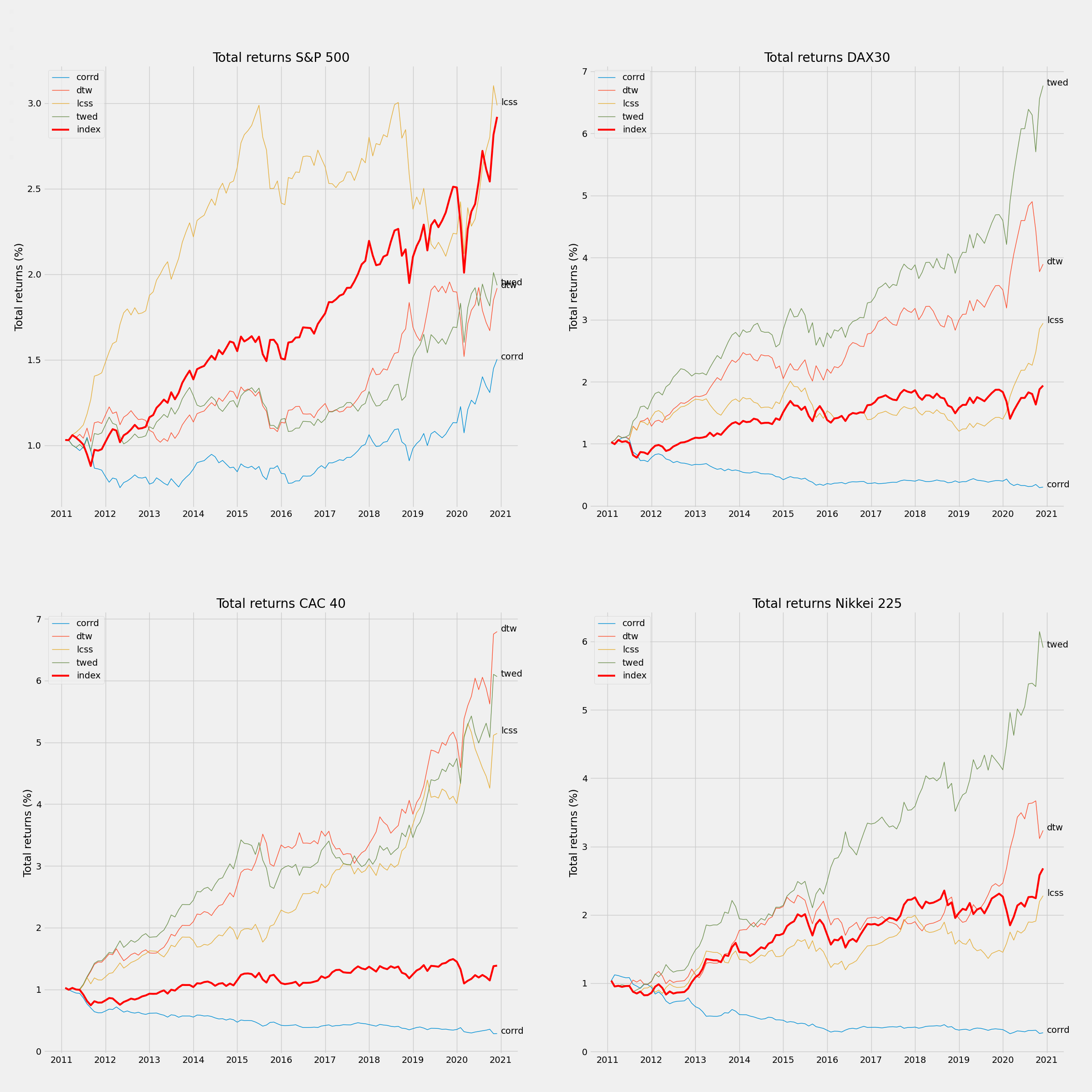

Pattern matching trading algorithms which compare the performance of different similarity measures such as DTW/TWED/LCSS/Corr. The distances calculated by the similarity measures are used as an input for KNN.

Methodology is based on the papers by Nagakawa, Imamura and Yoshida 1 & 2.

Basic instructions to run this script:

Create a new python env and install all the dependencies from requirements.txt.

Files:

update_data.py - Downloads Yahoo/Investing data. Output is a csv file with columns Date & Close.

prediction.py - Input: data in the folders&format provided by update_data.py, user inputs months given for out of sample (OOS) predictions.

Output: Calculates buy&sell predictions for OOS.

inference.py - Input: data in the folders&format provided by prediction.py. Output: Total returns plots and performance tables (total returns, alpha, accuracy) per input.

Functions:

stat_model.py - Contains statistical models (KNN, K*NN)

distance_model.py - Contains distance models (DTW, TWED, LCSS, Corr)

Research:

param_test* - parameter tests ran for TWED&LCSS

Results: