A PHP SDK for integrating with the pawaPay API, enabling seamless payment processing, transaction management, and other key functionalities such as deposit, refund and payouts handling API calls.

The pawaPay PHP SDK includes a comprehensive set of features designed to facilitate seamless payment integration with real-time verification:

-

Mobile Money Deposit Request

The SDK allows for making deposit request to mobile money accounts with built-in real-time transaction verification. Each deposit request is processed and validated immediately to ensure its status is current and accurate. -

Mobile Money Refund Request

-

Supports initiating refunds for previousdepositIdtransactions. Refund requests are validated in real time, allowing you to check the status of each refund as soon as it’s submitted. However, availability of refund functionality depends on your account configuration. -

Mobile Money Payout Request

-

Enables payouts to one or more recipients in a single transaction, with real-time verification of the payout status. This feature streamlines bulk payments and ensures all payout transactions are tracked in real time. -

Real-Time Verification for All Transactions

Whether making a deposit, issuing a refund, or processing a payout, the SDK ensures that all transactions are verified in real time, offering up-to-the-minute accuracy for all operations. -

Country-Specific Payment Configuration

The SDK dynamically fetches the list of supported Mobile Network Operators (MNOs) based on the country tied to your merchant account. This ensures that you only interact with active MNOs for deposits and payouts, preventing errors related to inactive operators. -

Mobile Network Operator (MNO) Status Check

Provides a real-time check on MNO availability, ensuring that deposits are only attempted when the operator is active. This helps avoid failed transactions due to inactive MNOs. -

Sandbox and Live Environments

The SDK supports both sandbox and live environments, allowing for testing in a sandbox before moving to live transactions. You can easily switch between the two environments by setting the appropriate API tokens and SSL verification logic. Here’s an example:// Set the environment (sandbox or production) $environment = getenv('ENVIRONMENT') ?: 'sandbox'; // Default to sandbox if not specified $sslVerify = $environment === 'production'; // SSL verification true in production // Dynamically construct the API token key $apiTokenKey = 'PAWAPAY_' . strtoupper($environment) . '_API_TOKEN'; // Get the API token based on the environment $apiToken = $_ENV[$apiTokenKey] ?? null;

The pawaPay PHP SDK provides a seamless integration of pawaPay's payment processing API with your PHP applications. It supports key functionalities such as deposit processing, real-time transaction verification, and refund handling, along with payouts to single or multiple recipients. All verifications are conducted in real time to ensure accurate and up-to-date transaction status.

Please note that the availability of certain features, such as country-specific payment options and refund capabilities, depends on the configuration of your merchant account. These settings may vary between sandbox and live environments.

Requires PHP versions: >= 8.0.0.

To install the SDK via Composer, run the following command:

composer require katorymnd/pawa-pay-integration- Environment Setup

After installing the SDK, you will need to configure your pawaPay API keys. Update the API keys securely in a .env file and save.

# .env

PAWAPAY_SANDBOX_API_TOKEN=your_sandbox_api_token_here

PAWAPAY_PRODUCTION_API_TOKEN=your_production_api_token_hereIn your browser, load the following file:

example/fetch_mno_conf.php

This file will load your MNO Availability and Active Configuration via the API and save the details. The entire SDK will rely on this configuration to process transactions.

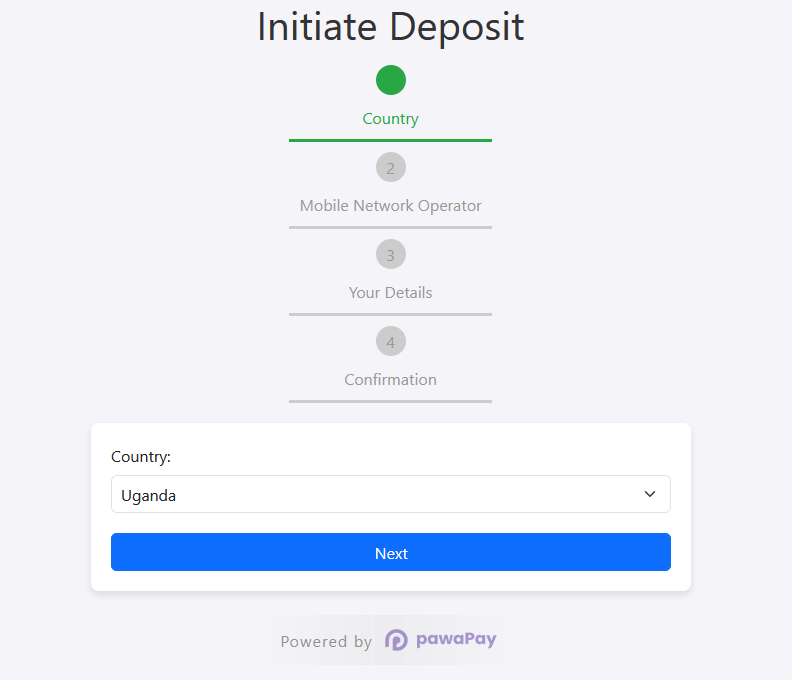

Once you have saved your MNO configuration by loading example/fetch_mno_conf.php, you will need to update the country dropdown and MNO availability checks in your HTML files. This ensures the SDK reflects the correct configuration for processing deposits and payouts.

You need to update the country dropdown in the relevant HTML files (e.g., example/initiate_deposit.html, example/payouts.html) to align with the countries assigned to your merchant account. Here’s an example of the updated dropdown:

<label for="country" class="form-label">Country:</label>

<select id="country" name="country" required class="form-select">

<option value="" disabled selected>Choose Country</option>

<option value="Benin" data-currency="XOF">Benin</option>

<option value="Burkina Faso" data-currency="XOF">Burkina Faso</option>

<option value="Cameroon" data-currency="XAF">Cameroon</option>

<option value="Congo" data-currency="XAF">Congo-Brazzaville</option>

<option value="Congo (DRC)" data-currency="CDF">Congo-Kinshasa (CDF)</option>

<option value="Congo (DRC)" data-currency="USD">Congo-Kinshasa (USD)</option>

<option value="Cote D'Ivoire" data-currency="XOF">Cote D'Ivoire</option>

<option value="Gabon" data-currency="XAF">Gabon</option>

<option value="Ghana" data-currency="GHS">Ghana</option>

<option value="Kenya" data-currency="KES">Kenya</option>

<option value="Malawi" data-currency="MWK">Malawi</option>

<option value="Mozambique" data-currency="MZN">Mozambique</option>

<option value="Nigeria" data-currency="NGN">Nigeria</option>

<option value="Rwanda" data-currency="RWF">Rwanda</option>

<option value="Senegal" data-currency="XOF">Senegal</option>

<option value="Sierra Leone" data-currency="SLE">Sierra Leone</option>

<option value="Uganda" data-currency="UGX">Uganda</option>

<option value="Zambia" data-currency="ZMW">Zambia</option>

</select>Once you've updated the country dropdown, you'll also need to configure the MNO status dynamically based on the saved MNO configuration. Here's an example of how to manage the MNOs for each country in JavaScript:

const mnoCorrespondents = {

Benin: [

{

name: "MTN Benin",

apiCode: "MTN_MOMO_BEN",

countryCode: "+229",

flag: "bj.png",

available: true,

img: "mtn.png",

},

{

name: "Moov Benin",

apiCode: "MOOV_BEN",

countryCode: "+229",

flag: "bj.png",

available: true,

img: "moov.png",

},

],

"Burkina Faso": [

{

name: "Orange Burkina Faso",

apiCode: "ORANGE_BFA",

countryCode: "+226",

flag: "bf.png",

available: true,

img: "orange-money-logo.jpg",

},

{

name: "Moov Burkina Faso",

apiCode: "MOOV_BFA",

countryCode: "+226",

flag: "bf.png",

available: false,

img: "moov.png",

},

],

Uganda: [

{

name: "MTN Uganda",

apiCode: "MTN_MOMO_UGA",

countryCode: "+256",

flag: "ug.png",

available: true,

img: "mtn.png", // Image name for MTN Uganda

},

{

name: "Airtel Uganda",

apiCode: "AIRTEL_OAPI_UGA",

countryCode: "+256",

flag: "ug.png",

available: true,

img: "airtel.png", // Image name for Airtel Uganda

},

],

// Add more countries and MNOs here...

};The functionaliy is:

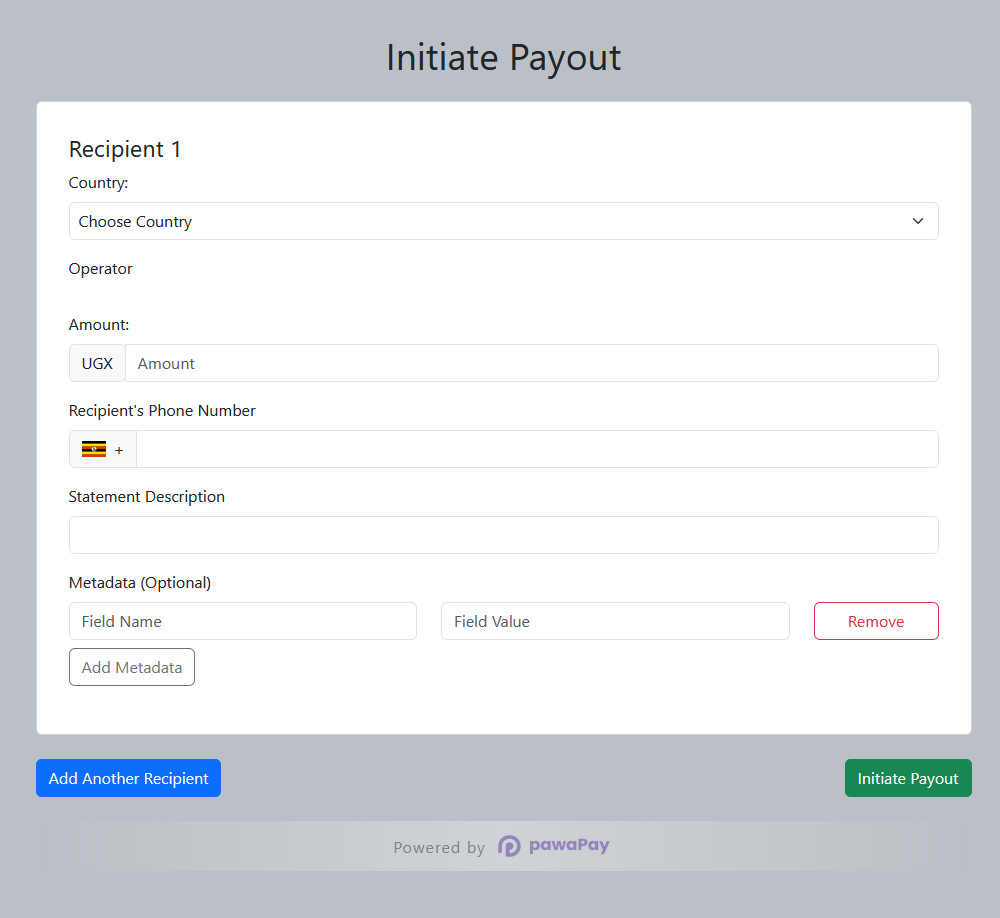

- When the user selects a country, the logic dynamically updates the list of available Mobile Network Operators (MNOs) for that country.

- The MNO options are based on the

mnoCorrespondentsobject, which contains details like MNO name, API code, availability, and country code. - If an MNO is marked as unavailable (

available: false), its option is disabled to prevent users from selecting it.

To test different functionalities of the pawaPay SDK, follow these steps:

-

Deposit Request: To test the deposit functionality, open the following page in your browser:

initiate_deposit.html -

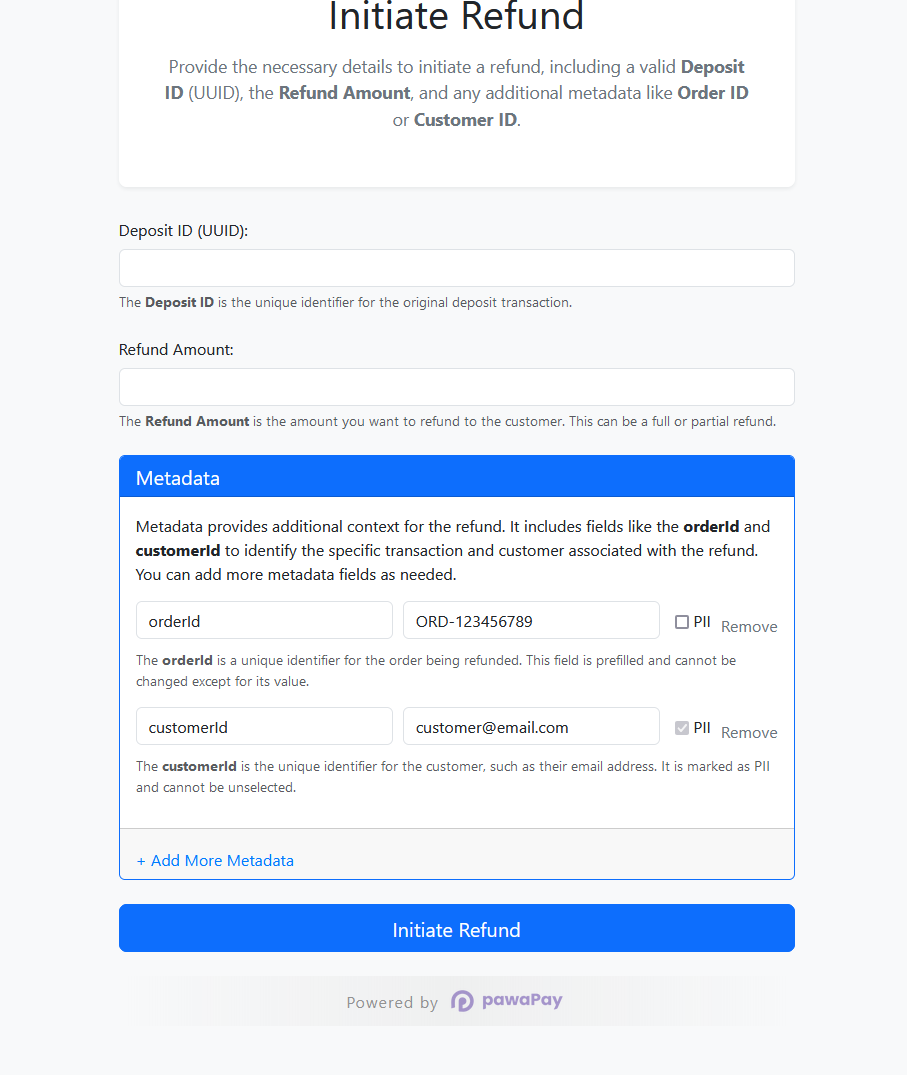

Refund Logic: To test the refunds logic, open the following page in your browser:

refund_form.html -

Payouts: To test the payouts functionality, open the following page in your browser:

payouts.html

For testing, please use the provided test phone numbers (MSISDNs) available in the official pawaPay documentation:

Important: Refunds can only be submitted once per deposit ID. Attempting to refund the same deposit ID multiple times will result in an error.

Additionally, every transaction—whether successful or not—will be logged in detail in the

logfiles. You can refer to these log files for an in-depth analysis of any transaction, ensuring you have a complete record for debugging and auditing purposes.

Explore these resources to get started and make the most of the pawaPay Payment SDK:

-

Getting Started With the pawaPay SDK: Installation and Setup

A beginner's guide to installing and setting up the SDK. -

How to Configure and Integrate pawaPay SDK: A Step-by-Step Guide

Detailed instructions on configuring and integrating the SDK into your PHP application.

If you need assistance integrating pawaPay into your application, or if you're not a developer but require this solution in another programming language, feel free to reach out for support. I'm available to help with custom integrations or to create versions of this SDK in other languages.

Contact me at: katorymnd@gmail.com

This project is licensed under the MIT License - see the LICENSE file for details.