This repository contains an implementation of an ARIMA model, specifically designed for predicting the prices of financial instruments such as currencies, stocks, and cryptocurrencies. The ARIMA model leverages sequential data to capture temporal dependencies in price movements. This approach enhances the accuracy and robustness of price forecasts across various datasets.

This is the original code sample for the ARIMA model. Explore my GitHub repository for additional models and implementations that cater to different financial prediction needs.

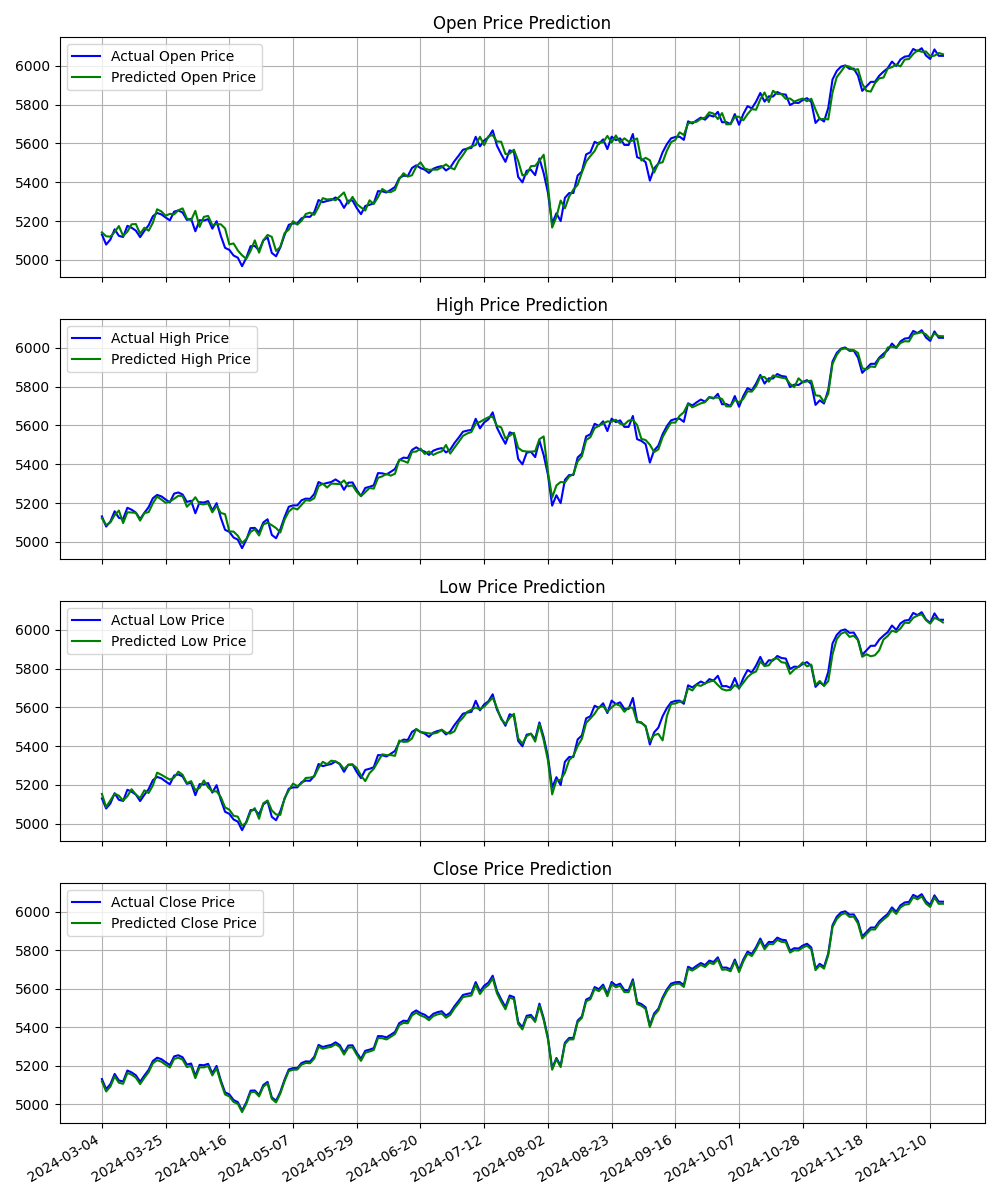

| Metric | Open | High | Low | Close |

|---|---|---|---|---|

| Mean Squared Error | 0.0004220947 | 0.0003331435 | 0.0003984997 | 0.0004212805 |

| Mean Absolute Error | 0.0146372866 | 0.0126685872 | 0.0146607014 | 0.0146472946 |

| R-squared | 0.9810292825 | 0.9853395246 | 0.9817388777 | 0.9815021491 |

| Median Absolute Error | 0.0098635477 | 0.0090989897 | 0.0110105436 | 0.0099024771 |

| Explained Variance Score | 0.9818170543 | 0.9860428103 | 0.9824947986 | 0.9822664621 |

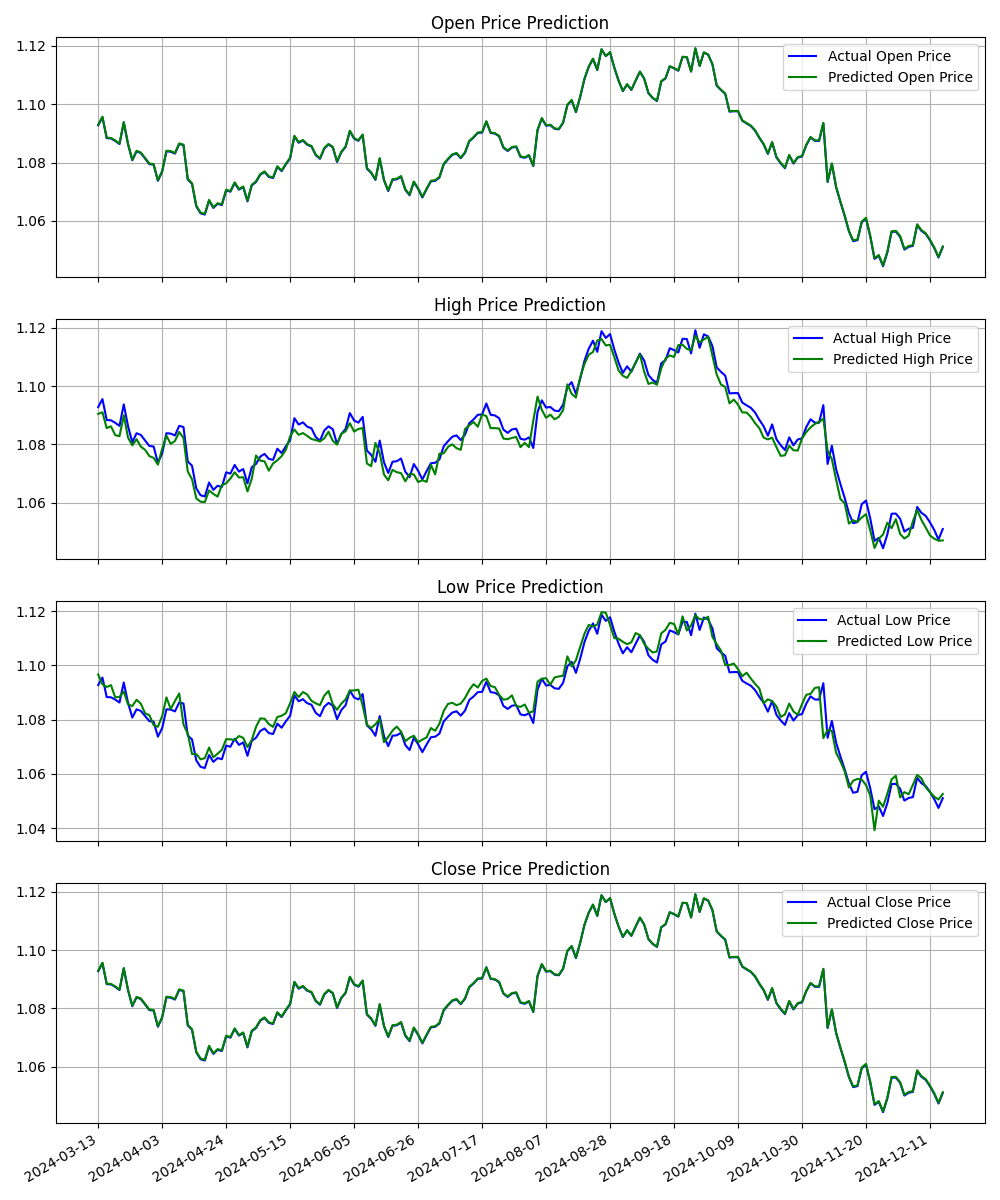

| Metric | Open | High | Low | Close |

|---|---|---|---|---|

| Mean Squared Error | 0.0004573659 | 0.0003971889 | 0.0004150386 | 0.0004928941 |

| Mean Absolute Error | 0.0167200327 | 0.0159885584 | 0.0158186869 | 0.0180250496 |

| R-squared | 0.9778359028 | 0.9805231187 | 0.9799143807 | 0.9758534936 |

| Median Absolute Error | 0.0135381585 | 0.0136399818 | 0.0121453137 | 0.0159585536 |

| Explained Variance Score | 0.9807082959 | 0.9832689722 | 0.9825208334 | 0.9786981397 |

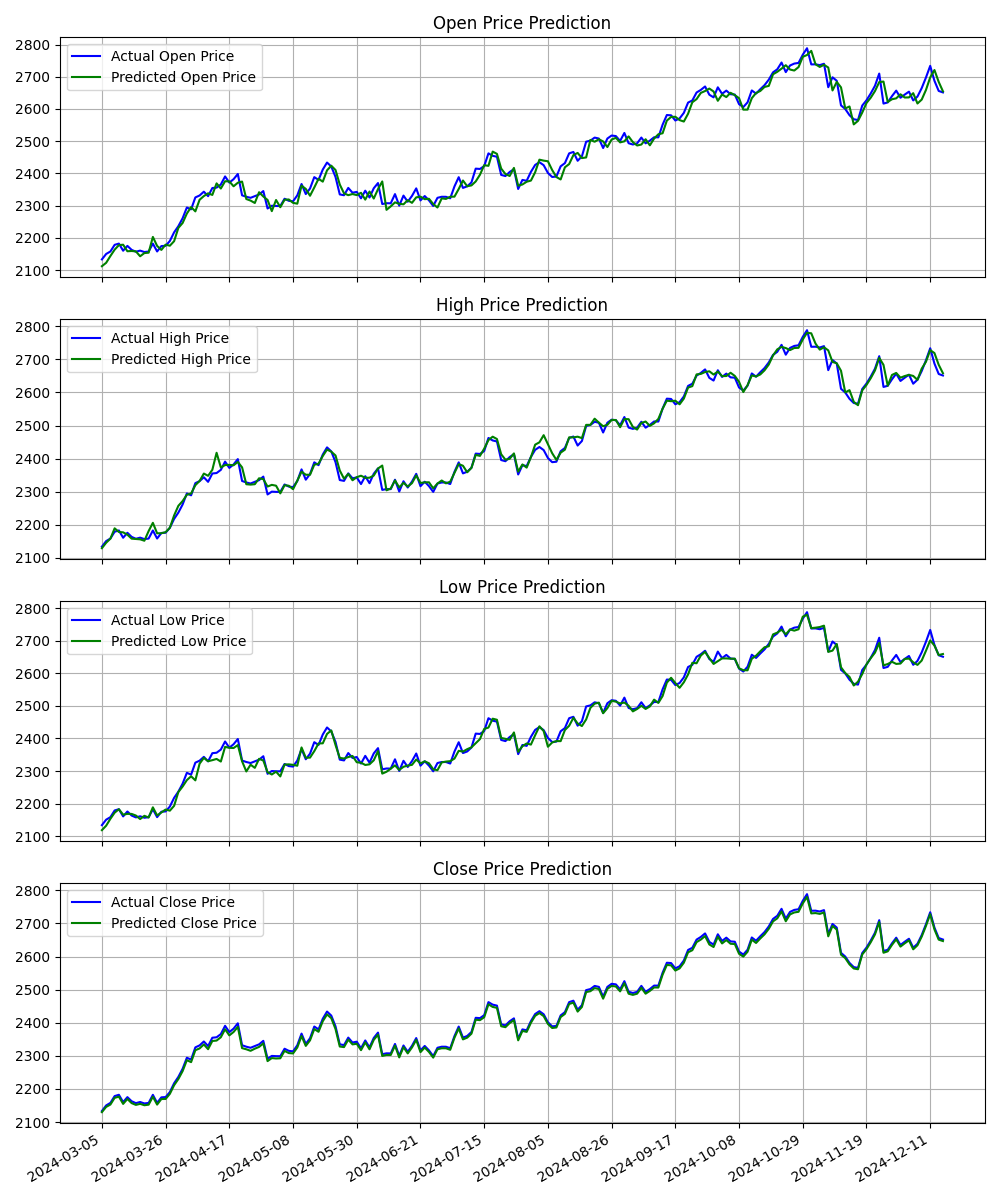

| Metric | Open | High | Low | Close |

|---|---|---|---|---|

| Mean Squared Error | 0.0002369469 | 0.0001820074 | 0.0001921452 | 0.0002373472 |

| Mean Absolute Error | 0.0116501358 | 0.0101599818 | 0.0100425842 | 0.0116962016 |

| R-squared | 0.9450968898 | 0.9586449824 | 0.9564474468 | 0.9451307259 |

| Median Absolute Error | 0.0094959702 | 0.0077570867 | 0.0078760936 | 0.0094959108 |

| Explained Variance Score | 0.9455610091 | 0.9590999878 | 0.9568867818 | 0.9456283529 |

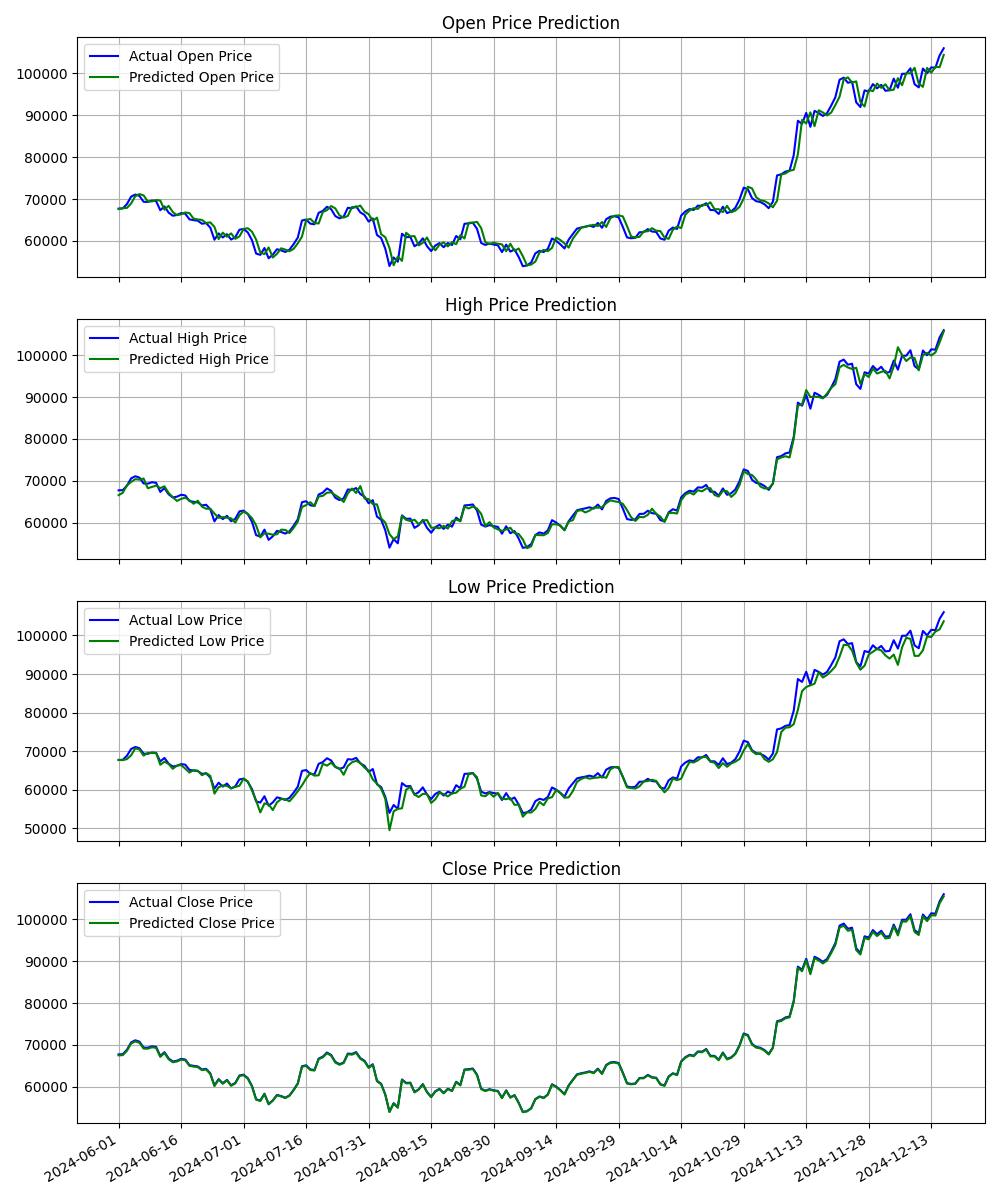

| Metric | Open | High | Low | Close |

|---|---|---|---|---|

| Mean Squared Error | 0.0002943897 | 0.0002285942 | 0.0002763461 | 0.0003238685 |

| Mean Absolute Error | 0.0131037101 | 0.0112381038 | 0.0125061849 | 0.0138794599 |

| R-squared | 0.9781312129 | 0.9838436549 | 0.9794671490 | 0.9771475967 |

| Median Absolute Error | 0.0109432769 | 0.0086268191 | 0.0099983815 | 0.0114295848 |

| Explained Variance Score | 0.9805361261 | 0.9859285360 | 0.9817389733 | 0.9797225138 |

The experiences of these codes and the initial models you see have been used on the following sites:

Free AI-powered short-term (5/10/30 days) & long-term (6 months/1/2 years) forecasts for cryptocurrencies, stocks, ETFs, currencies, indices, and mutual funds. Predict Price employs a unique ARIMA model that analyzes historical data in both forward and reverse directions, capturing intricate temporal patterns. This advanced methodology ensures precise and reliable forecasts, setting it apart in the market.

Get free trading signals generated by advanced AI models. These models utilize state-of-the-art machine learning techniques to analyze market dynamics, identify trends, and predict potential price movements. Examples of successful signals include precise predictions of market reversals and breakout points, helping users optimize their trading strategies with confidence.

Discover free trading signals powered by expert technical analysis. This platform employs a variety of technical analysis methods, such as trendline studies, Fibonacci retracements, and moving average strategies, to generate actionable insights. These techniques provide users with detailed real-time market updates, enabling them to refine their forex, stock, and crypto trading strategies effectively.

About This Project

This ARIMA model is an initial implementation, released for public use. The project demonstrates the potential of deep learning models for financial predictions. While this repository focuses on ARIMA, I have also utilized other models, the code for which is available on my GitHub.

How to Use

Clone this repository.

Install the required libraries: pip install -r requirements.txt

Prepare your dataset and follow the instructions in the notebook or script.

Run the model and evaluate its performance using the provided metrics.

License

This project is open-source and available for public use under the MIT License. Contributions and feedback are welcome!