This project is a comprehensive tool for analyzing stocks and pricing options using two models:

-

Black-Scholes Model

-

Monte Carlo Simulations

It includes features such as stock price visualization with moving averages, RSI calculation, next-day stock price prediction, and interactive visualizations.

-

Black-Scholes Option Pricing

-

Calculates the price of European-style options.

-

Outputs key metrics known as Greeks:

-

Delta: Rate of change of the option price with respect to the stock price.

-

Gamma: Rate of change of Delta with respect to the stock price.

-

Theta: Rate of change of the option price with respect to time.

-

Vega: Sensitivity of the option price to volatility.

-

Rho: Sensitivity of the option price to interest rates.

-

-

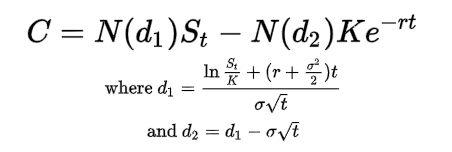

Call Option (C) is calculated using the following formula:

-

Put Option (P) is calculated using the following formula (the same formulas for d1 and d2 are used as above):

-

-

Monte Carlo Simulation

-

Simulates multiple stock price paths to estimate the price of European-style options.

-

Interactive graph to visualize up to 10,000 simulated paths.

-

Simulation

-

Each price path is modeled using the stochastic differential equation where:

-

Time step (trading days = 252/year)

-

Random variable sampled from a standard normal distribution

-

-

-

-

Stock Data Visualization

-

Historical stock prices with 20-day, 50-day, and 200-day moving averages.

-

Relative Strength Index (RSI) with overbought (70) and oversold (30) levels.

-

-

Next-Day Stock Price Prediction

- Predicts the next closing price using linear regression trained on historical stock data.

-

Streamlit-Based Interface

-

Interactive web interface with:

-

Input fields for stock ticker, strike price, volatility, risk-free rate, and time to maturity.

-

Option to select between Black-Scholes or Monte Carlo models.

-

Dynamic graphs for simulation paths and plot visualization.

-

-

-

Python 3.8 or higher

-

Required libraries:

-

numpy

-

pandas

-

scipy

-

sklearn

-

plotly

-

streamlit

-

yfinance

-

-

Install these dependencies using "pip install"

-

After navigating to the project directory, run using:

python -m streamlit run main.py

-

Select Pricing Model

- Choose either "Black-Scholes" or "Monte Carlo" from the sidebar.

-

Input Parameters:

-

Enter stock ticker symbol (e.g., AAPL).

-

Specify strike price, volatility, risk-free rate, time to maturity, and option type (call/put).

- The 10 year treasury yield is used for the risk free rate

-

If using Monte Carlo, adjust the number of simulation paths.

-

-

Visualize Results:

-

View historical stock price with moving averages and RSI.

-

See predicted next closing price.

-

Get the option price and Greeks for Black-Scholes or the simulated price paths for Monte Carlo.

-

-

main.py: Streamlit interface for the application.

-

stock_prediction.py: Handles data fetching, preparation, and price prediction.

-

MonteCarloBasic.py: Contains Monte Carlo simulation logic and interactive path visualization.

-

blackScholes.py: Implements the Black-Scholes model and Greeks calculation.

-

requirements.txt: Lists project dependencies.

-

Fork the repository.

-

Create a new branch:

git checkout -b feature-name -

Commit your changes:

git commit -m "Add new feature" -

Push to the branch:

git push origin feature-name -

Open a pull request.